Abstract Housing is a social and developmental issue of public concern, which is related to the personal interests of every household and the people’s “living in a home”. The article quantifies the housing choice behavior of urban residents by the ring index of residential housing purchase price, and solves the problem of sample selection error by using the propensity to match score to match the experimental group and the control group. A double difference model is used to analyze the net effect of the implementation of housing market regulation policies on urban residents’ housing choice behavior. Parallel trend test in the experimental and control groups before and after the implementation of housing market regulation policies in 2018 shows significant differences, the ATT value of HSB after propensity score matching is positive, and the sample mean of the control group is 0.452 lower than that of the experimental group. The coefficient of the effect of housing market regulation policies on the behavior of urban residents’ housing choices is 0.351 and shows significance at the 1% level. The active implementation of housing market regulation policy can help optimize the housing purchase price index, which in turn stimulates the housing choice behavior of urban residents and promotes the stable and healthy development of the housing market.

Real estate industry is the industry with great relevance, which has a significant role in developing economy and improving people’s housing environment, and from the macroeconomic level, real estate industry is in the leading, basic and pillar position in the national economic system, and it is undoubtedly important to maintain the healthy and orderly development of real estate industry [1-3]. The real estate market is an important part of the market-oriented construction link in the process of China’s market economy construction, and is also the carrier of the healthy and orderly development of real estate industry [4-6].

At present, China is in the macro background conditions of industrialization, informationization, urbanization, marketization and internationalization, the purpose of real estate market regulation is to ensure that the macroeconomic regulation and control to achieve good results and the real estate industry healthy and orderly [7,8]. The goal of real estate market regulation is clear, by giving full play to the fundamental role of resource allocation, to overcome the real estate market’s own shortcomings, to prevent the larger market fluctuations that it may cause, which is the main goal of real estate market regulation, in a nutshell, is to maintain the real estate market sustained, healthy and stable development [9-11].

Real estate market regulation is the core of real estate economic regulation [12]. Real estate economic regulation contains the regulation of the real estate market, and real estate market regulation is the core content of real estate economic regulation, in the study of real estate market regulation, due to the factors affecting the market to a large extent in the real estate market practice activities reflected in the real estate market practice, therefore, can not be separated from the study of real estate market practice [13,14]. Similarly, market regulation as a key subsystem of real estate economic regulation and control, and its own independent laws, its own independent laws and other aspects of the interaction of the real estate market together [15,16]. The sustainability, health and stability of the real estate market is largely reflected through price stability, therefore, in all aspects of the regulatory factors, price regulation is undoubtedly important. Excessive changes in real estate prices can have a huge ripple effect on social and economic activities, which can easily lead to a series of problems [17-19].

The regulation of real estate market prices will play a positive role in adjusting the magnitude of price changes in the real estate market and solving some of the prominent contradictions and problems in the development process of China’s real estate industry [20,21]. Real estate market regulation has become one of the important contents of China’s national macro-control, but at present the regulation of China’s real estate market has not received the desired effect, which triggers us to think about the series of deep-seated reasons for the unsatisfactory effect of real estate market regulation [22,23]. On the one hand, we should focus on the study of the economic laws of real estate market fluctuations, and on the other hand, how to improve the countermeasure ideas from the governmental level to promote the healthy and orderly development of China’s real estate industry through real estate market regulation [24-26].

This paper proposes a method to quantify the housing choice behavior of urban residents based on the residential housing purchase price index, and analyzes the specific impact of housing market regulation policies on urban residents’ housing choice behavior in combination with PSM-DID model. With the starting point of meeting the people’s needs for a better life, a number of regulatory policies related to the housing market have been introduced around “stabilizing land prices, housing prices and expectations”, aiming at realizing a better home and the stable development of the housing market. In this regard, based on the selection of appropriate indicators to measure the housing market control policies and urban residents’ housing choice behavior, this paper compiles the impact of housing market control policies on the demand for housing and residents’ housing choice behavior. Using the housing regulation policy data of 116 Chinese cities and the CGSS database as the data source, the PSM is used to solve the error of different samples, and then the DID model is introduced to construct the PSM-DID model to analyze the degree of influence of the housing market regulation policy on residents’ housing choice behavior. A placebo test is also conducted to illustrate the reliability of the regression results and to provide a new research example for stabilizing the housing market.

The housing issue has a bearing on people’s well-being, so that the people can have a place to live and new citizens and young people can be helped to alleviate their housing difficulties, which requires the implementation of a practical policy. With the rapid development of the real estate market, housing prices have also shown a rapid increase. Rapidly rising housing prices have led to a series of problems, such as a decrease in the purchasing behavior of residents, the strengthening of the attributes of housing investment products, and an increase in the risk of the housing market, which endangers macroeconomic stability. The housing market control policy is a policy innovation in the second round of real estate market control that restricts the re-transfer of newly purchased commercial housing, and is designed to discourage speculative purchases by reducing the liquidity of housing in order to promote market stability.

The housing market is a place where transactions are carried out in relation to property and real estate. And in the housing market, real estate transactions between the two sides of the purchase and sale of behavior, at the same time with the dual attributes of housing ownership and land use rights transactions. After the reform of the function of the government system, the real estate right certificate replaces the real estate certificate and the land certificate, combining the two into one, and at the same time to indicate the relevant rights on the top of this certificate.

Housing market regulation policy refers to the government from the overall social and economic objectives, combined with the real estate market industry law, in the legal means, economic means and other means of comprehensive use of the basis to regulate and control the development of the real estate market, in order to achieve the optimization of the market structure and the overall balance of supply and demand, and to promote the coordinated development of the industry and the national economy and the total of all kinds of systems [27]. The government’s regulatory policy, the purpose is not to limit the market, but to make up for the impact of market failure. The external manifestation of the regulatory policy is mainly divided into land policy, monetary policy, administrative policy, etc. In recent years, the common ones are limiting the number of housing units purchased by households, household registration restrictions, increasing the proportion of down payment, bank lending interest rate adjustments, “lottery” purchase of housing, sales tax concessions such as tax adjustments.

The act of housing consumption is the internal activity and external manifestation of the process of acquiring, using and disposing of housing and related services in order to satisfy one’s own or others’ need for housing, which involves the stages of searching, purchasing, using and evaluating.

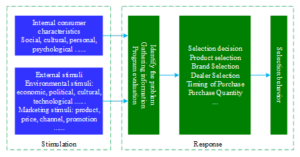

The choice of housing is made in the commodity market, not in the distribution system, and the object of the choice of housing refers specifically to the commodity housing and related services traded in the market, excluding commercial or self-built housing, and excluding housing as a channel for investment. The subject of residential choice is the housing consumer in the narrow sense, i.e., the individual or household, rather than any type of unit. This paper builds the research idea of urban residents’ housing choice behavior pattern from the research paradigm of “stimulus-response”, and its specific structure is shown in Figure 1. Factors affecting urban residents’ housing choice decisions can be divided into two major parts: internal and external. Internal factors are consumers’ own psychological characteristics and long-term accumulated social and cultural influences, while external factors are relatively short-term external stimuli, such as the macroeconomic situation, housing market control policies, and the marketing environment created by some or even all developers.

The consumption behavior path of urban residents’ housing choices is “motivation-perception-decision-making”. The multiple motives of urban residents for choosing housing will have an effect on consumption perception, which will have an important impact on decision-making behavior, and ultimately the motives will have an indirect effect on decision-making through perception.

Housing market demand is mainly the demand for housing by homebuyers, which is mainly divided into three types, the first of which is just demand, which refers to the most fundamental need of homebuyers for housing, that is, the need for self-occupation, mainly referring to the purchase of the first suite of people. The second is the need to improve the quality of life and living environment, from “housing demand” to “comfort demand”, which is characterized by the purchase of homes to improve living conditions and choose a bigger and better living environment. The third type is the investment need, which is the need to purchase a residence in order to obtain rent or capital appreciation, or both.

Starting from the housing market regulation policy, it stimulates to a certain extent the demand of urban residents to buy houses, which will largely further influence the housing choice behavior of urban residents. Relying on the housing market regulation policy to empower urban residents to enhance the demand for improved housing quality, coupled with the adjustment of the fertility policy, the increase in the number of families with multiple children at the same time to release some of the demand for home exchange driven by the increase in the size of the family and the urgent need to improve the large-area, large-family homes. Coupled with financial and other policy support, urban housing demand, especially improved housing demand, will continue to release.

In housing choice theory, the new institutional economics believes that changes in market macro-control policies affect people’s housing choice behavior. The government pays more attention to the housing sale and rental market, and is more inclined to the development and protection of the housing sale market in terms of policy, prompting the inequality of housing services enjoyed by buying and renting, such as the purchase of a house to own a household registration, and the requirement for children to attend school in the vicinity of the school to have to have a house, and so on. When the housing rental market, tenants do not have a stable rental housing, often face the risk of moving at any time, at any time to face the risk of rent increases at any time, the rights and interests can not be guaranteed, the lack of protection measures for the rights and interests of tenants in the housing rental market, but also to promote the preference of people to buy a home.

For housing services, on the one hand, only buy a house to enjoy the settlement, children can be near the school, on the one hand, the interests and rights of renting are not guaranteed, but also to further affect the attitude of people to live in the housing rent and buy options, in the housing services, owned housing is significantly higher than rental housing, also prompted people to prefer to buy a house. Thus, it can be significantly found that the formulation and implementation of housing market control policies can effectively promote the housing choice behavior of urban residents, more willing to start from the perspective of housing purchase housing choice, in order to meet the necessity of work, life and children’s learning.

As China’s economy develops, the housing market continues to evolve through continuous exploration. Over the past few decades, the housing market has prospered as the system of urban construction and commercialization of housing has continued to advance. In order to ensure the health and stability of China’s housing market, the government has introduced different types of macro-control policies. From the perspective of housing market regulation policies, exploring the extent of their impact on the housing choice behavior of urban residents will help to build a long-term mechanism to maintain the stability of the housing market from multiple perspectives in line with the characteristics of urban development as well as the health, well-being, and development of the residents.

Source of data on urban residents’ housing choice behavior The data on urban residents’ housing choice behavior comes from the China General Social Survey (CGSS), which is a national, comprehensive, and continuous academic survey program that comprehensively collects data at multiple levels of society, community, family, and individual. Considering the problem of sample unification, the variables are selected as comprehensively as possible, and this time, the data of urban residents’ housing choice behavior in 2015 and 2023 are mainly selected.

Data sources of housing market regulation policies The panel data of this paper comes from multiple data sources, including China Urban Statistical Yearbook, Guoxin Real Estate Information Network, etc., and the purchase restriction policy is collected from news, official website of the Ministry of Housing and Construction, official website of the People’s Bank of China, official website of the government, and other public information documents. The sample period chosen for this paper is 96 months of data from January 2015 to December 2023, given that Chinese cities have implemented differentiated housing purchase restriction policies based on “city-specific policies and categorized controls”. The study is segmented into different rounds of housing market control policies to ensure a sufficiently long sample period to explore the impact of housing market control policies on urban residents’ housing choice behavior. In addition, considering the completeness of the data, this paper, based on the data collected from 328 prefecture-level cities, excludes 212 prefecture-level cities with serious missing data, leaving 116 cities as the final sample cities.

Propensity Matching Score (PSM)

When conducting the analysis of the impact of housing market regulation policies on the housing choice behavior of urban residents, it may have a certain selection bias. In order to minimize its selection bias, this paper divides the survey samples into treatment and control groups, and introduces the PSM method to achieve the matching of multiple variable factors [28].

The basic idea of propensity score matching is to find two groups of samples by calculating the propensity score value, which are almost the same in terms of other characteristic variables except whether they enjoy the housing market regulation policy or not. Since the difference between these two groups of samples only lies in whether or not they enjoy the housing market regulation policy, the difference in citizens’ housing choice behavior between the two groups of samples can be attributed to whether or not they enjoy the housing market regulation policy, and the impact of the housing market regulation policy on citizens’ housing choice behavior can be explained by the average treatment effect (ATT).

Whether urban residents’ housing choice behavior enjoys housing security is not randomly assigned, but is determined by a set of characteristic variables. Therefore, the conditional probability of urban residents’ housing choice behavior to enjoy housing security given the characteristic variable \(X\) is: \[\label{GrindEQ__1_} P\left(X\right)=\Pr \left[T=1\left|X\right. \right]=E\left[T\left|X\right. \right], \tag{1}\] where \(T\) represents an intervention state, \(T=1\) if the urban residents’ housing choice behavior enjoys the housing security policy, and \(T=0\) if the urban residents’ housing choice behavior does not enjoy the housing security policy. \(P\left(X\right)\) is the tendency score value. At the same time, if \(Y\) represents the result, i.e., urban residents’ willingness to citizenship of housing choice behavior, \(Y_{1}\) represents urban residents’ willingness to citizenship of housing choice behavior that enjoys housing security policy, and \(Y_{0}\) represents the willingness to citizenship that does not enjoy housing security policy, the theoretical framework can be expressed as follows: \[\label{GrindEQ__2_} Y=\left(1-T\right)Y_{1} +TY_{0} . \tag{2}\]

This model allows to state which of the two outcomes will be observed in reality, depending on the intervention state \(T\).

The ATT is used to measure the average intervention effect, i.e., the difference between the observed willingness to citizenship of an urban resident housing choice behavior in the state of enjoying housing security and the observed willingness to citizenship of this urban resident housing choice behavior in the state of not enjoying housing security, is called the standardized estimate of the average intervention effect. If propensity score value \(P\left(X\right)\) is known, then the average treatment effect estimate (ATT) of enjoying housing security for a particular urban resident housing choice behavior individual \(i\) is: \[\label{GrindEQ__3_} \begin{array}{rcl} {ATT} & {=} & {E\left[Y_{1i} -Y_{0i} \left|T_{i} =1\right. \right]} \\ {} & {=} & {E\left\{E\left[Y_{1i} -Y_{0i} \left|T_{i} =1\right. ,P\left(X_{i} \right)\right]\right\}} \\ {} & {=} & {E\left\{E\left[Y_{ui} \left|T_{i} =1\right. ,P\left(X_{i} \right)\right]-E\left[Y_{0i} 0,P\left(X_{i} \right)\right]\left|T_{i} =1\right. \right\}} \end{array} . \tag{3}\]

Based on the basic idea of PSM, the above derived formula needs to fulfill the following two assumptions:

First, conditionally independent distribution. That is to say the sample obeys an independent distribution under the characteristic variable X that does not affect whether urban residents’ housing choice behavior enjoys the housing security policy or not.

Second, a common branch of hypotheses. Hypothesis \(0<P\left(X\right)<1\), i.e., whether or not to enjoy the housing security policy has a positive probability under the same characteristic variable \(X\). The common support hypothesis can exclude samples of urban residents’ housing choice behavior whose propensity score values are in the tails and improve the quality of matching.

Double Difference Modeling (DID)

The double difference model is mostly used to evaluate the implementation effect of policies, which is based on the principle of starting from a counterfactual framework to study the situation of implementing policies and not implementing policies, through an exogenous policy, the experimental samples are divided into experimental and control groups to study the variable changes, and then circumvent the endogeneity problem. This paper extends the method to establish a dynamic panel data regression analysis model based on double difference model. The double difference model applies the condition that there is no need to change the control group, and the experimental group’s relevant research variables change while the policy is implemented. The experimental group and the control group research variables change should be consistent, that is, to comply with the common trend assumption, if there is no exogenous policy impact.

This paper develops a dynamic panel data model based on the double difference approach. The double difference model can be set up as: \[\label{GrindEQ__4_} Y_{it} =\beta _{0} +\beta _{1} \times Policy\times Time+\beta _{2} \times Policy+\beta _{3} \times Time+\varepsilon _{it} \tag{4}\] where \(Policy\) and \(Time\) are two sets of dummy variables, \(Policy=1\), represents the experimental group, \(Policy=0\), represents the control group, \(Time=1\), represents the exogenous policy shock at and after the exogenous policy shock, \(Time=0\), represents the exogenous policy shock before the exogenous policy shock, and \(\varepsilon _{it}\) is the random perturbation term [29]. And the coefficient of the interaction term in Eq. (4), \(\beta 1\), which is the net effect of the policy treatment of the double-difference model that needs to be observed in this paper, can be expressed as its estimator: \[\label{GrindEQ__5_} \beta _{1} =\left(\bar{Y}_{Policy=1,Time=1} -\bar{Y}_{Policy=1,Time=0} \right)-\left(\bar{Y}_{Policy=0,Time=1} -\bar{Y}_{Policy=0,Time=0} \right) . \tag{5}\]

PSM-DID combination model

The DID model is used to assess the average effect and dynamic marginal effect of the impact of housing market regulation policies on the housing choice behavior of urban residents. The PSM-DID model is constructed through propensity matching scores to the effect of housing market regulation policies on urban residents’ housing choice behavior, solving the problem of sample selection error and matching experimental and control groups. It is difficult to satisfy the common tendency assumption by using the DID model alone to test the effect of housing market regulation policies on urban residents’ housing choice behavior. That is, there are large differences between the experimental and control groups in terms of observable characteristics, and thus no precise net effect of the policy treatment can be derived. Ensuring that the experimental and control groups satisfy the common trend assumption, the problem of sample selection error is overcome by introducing the propensity score matching method. Thus, the sample prerequisites for the use of double difference models are satisfied, and thus this paper combines the use of PSM and DID to construct the PSM-DID model.

In order to study the impact of housing market regulation policies on urban residents’ housing choice behavior, based on the previous analysis of the correlation between housing market regulation policies and residents’ housing choice behavior. The explanatory variable chosen in this paper is the residents’ housing choice behavior (HSB), in order to examine the effect of the implementation of the housing market control policy, using the residents’ housing purchase price chain index. The core explanatory variable is a dummy variable for the implementation of the housing market control policy (Treat), which takes the value of 1 if the housing market control policy is implemented, and 0 if it is implemented, and a time dummy variable (Time), which takes the value of 1 in the year of the impact point of the housing market control policy and the following years, and 0 in the previous years.

In addition, in order to further illustrate the degree of influence of the core explanatory variables on the explanatory variables, the paper also selects the Gross Domestic Product (GDP), Per Capita Disposable Income of Urban Residents (PCDL), Consumer Price Index (CPI), Year-on-Year Growth Rate of Money Supply (M2), Loan Interest Rate (Rate), Surface Area of Residential Completion (SQR), and Percentage of Residential Investment Volume (INVEST), Residential sales-area (Sales-area), residential sales amount (Sales), the number of urban resident population (PP), and the land transaction price (Land) are used as control variables. In addition, in order to eliminate the effect of heteroskedasticity of different variables, this paper is logarithmic treatment for each control variable, so as to achieve the unification of the data.

Based on the previous selection of model variables and the PSM-DID model, this paper takes urban residents’ housing choice behavior as the object of study, in order to overcome or eliminate the inherent heterogeneity of incremental and non-time-varying changes in different residents’ housing choice behavior over time. The PSM-DID model is chosen to study the differences in the impact on urban residents’ housing choice behavior before and after the implementation of housing market regulation policies. After the isomorphic balance test of the two groups before and after the housing market regulation policy screened by the score matching method, the DID model was started to be used to compare the difference in the impact of the housing market regulation policy on the experimental and control groups. It is modeled as follows: \[\label{GrindEQ__6_} HSB_{i,t} =\alpha _{0} +\alpha _{1} Time_{i,t} +\alpha _{2} Treat_{i,t} +\alpha _{3} Time_{i,t} *Treat_{i,t} +\alpha _{4} Control_{i,t} +\varepsilon _{i,t} , \tag{6}\] where \(HSB_{i,t}\) denotes the housing choice behavior of urban residents, \(Time_{i,t} *Treat_{i,t}\) is a cross-multiplier term, where \(Time_{i,t}\) is a time dummy variable before and after the implementation of the policy, and \(Treat_{i,t}\) denotes a dummy implementation variable for the housing market regulation policy. \(Control_{i,t}\) denotes the various control variables selected in the course of the study, and \(\varepsilon _{i,t}\) is the random interference term. \(\alpha _{0}\) is the constant term, and \(\alpha _{1} \sim \alpha _{4}\) is the regression coefficient of each variable.

The healthy and balanced development of the housing market is one of the greatest concerns of residents and a key point of livelihood concern for the Government. The housing market has grown rapidly since the completion of market-oriented reforms, and indicators of affordability, such as housing market prices and house price-to-income ratios, have remained at a high level for a long time. Based on the significant impact of housing on people’s livelihood and the national economy, the government has frequently issued housing market regulation policies over the years, and the housing market has also shown the trend of the government’s regulation force involution. Housing market control policies such as “purchase restriction” and differentiated credit have been implemented in China for a long time, and there are clear policy texts, which can visually reflect the government’s thinking and intention to regulate the housing market, and have a greater impact on the housing market.

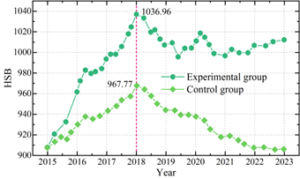

The prerequisite assumption for the use of the double-difference method that cannot be ignored is that the experimental group and the control group should have the same consistent development trend of the explanatory variables before the experiment, that is, they should have the same trend of the “time effect”, and that they must satisfy the assumptions of homogeneity and randomness in order to be able to assess the impact of the policy on the two groups after its implementation. If there are systematic differences between the treatment and control groups, this will largely bias the results. As a result, a parallel trend test was conducted for the experimental and control groups, and the trend of the average value of the chain index of residential housing purchase prices for the two groups is shown in Figure 2.

As can be seen by the development trend of the average value of the ring index of residential housing purchase prices of the two groups, before 2018, the price indexes of the two groups were in a phase of rapid increase, in which the ring index of residential housing purchase prices of the experimental group increased from 907.42 in 2015 to 1036.96 in 2018, and the index of the control group increased from 905.37 to 967.77. After the implementation of the housing market regulation policy, the trends of the experimental and control groups began to show significant differences, especially in the later stages of the control group declined more significantly, and the treatment group slowly declined. Therefore, it can be considered that the experimental and control groups in this model meet the requirements of parallel trends and pass the parallel trend test, indicating that the results of this paper’s choice to use the double-difference method to assess the impact of the housing market regulation policy on the housing choice behavior of urban residents are credible.

This paper adopts the propensity score matching method to study the impact of housing market regulation policies on the housing choice behavior of urban residents, due to the differences in the various control variables between different regions will have different impacts on the housing choice behavior of urban residents. Therefore, this paper first utilizes Logit regression to synthesize all control variables into propensity matching values, and the Logit regression results are shown in Table 1. According to the Logit regression results show that the regression coefficient of each control variable is greater than 0, indicating that each control variable will enhance the impact of the housing market regulation policy on the housing choice behavior of urban residents to a certain extent. Relying on the control variables to enhance the implementation level of housing market regulation policies provides support for promoting the housing choice behavior of urban residents.

| Variable | Coefficient | Standard deviation | Z Value | p value |

| GDP | 0.085 | 0.109 | -1.622 | 0.011 |

| PCDL | 0.414 | 0.013 | -0.156 | 0.007 |

| CPI | 2.315 | 0.028 | -1.781 | 0.008 |

| M2 | 0.334 | 0.002 | 0.264 | 0.004 |

| Rate | 0.028 | 0.738 | 4.938 | 0.005 |

| SQR | 0.147 | 0.139 | -3.702 | 0.000 |

| INVEST | 0.632 | 0.027 | 4.831 | 0.006 |

| Sales-area | 0.001 | 0.035 | 0.843 | 0.012 |

| Sales | 0.243 | 0.052 | -4.896 | 0.013 |

| PP | 0.335 | 0.405 | -2.415 | 0.004 |

| Land | 0.027 | 0.596 | 5.292 | 0.006 |

| (Con_) | 1.428 | 0.824 | 1.543 | 0.041 |

| LR chi2 | 145.18 | |||

| Prob chi2 | 0.000 | |||

| Pseudo R2 | 0.179 | |||

In this paper, three propensity score matching methods, nearest neighbor matching method, radius matching method and kernel matching method, were used for matching respectively. The ATT results of univariate analysis are shown in Table 2, and the three methods of matching show no difference in the results, so this paper only uses the nearest neighbor matching method for univariate analysis. Before matching, the gap between the HSB of the experimental group and the control group is significantly larger than after matching, which can be seen that the gap between the two explanatory variables of the experimental group and the control group before matching is exaggerated, and the difference after matching can reflect the reality more realistically. After matching, the ATT of HSB is positive, indicating that the samples optimized by the housing market regulation policy are matched for propensity score to get the control group samples with similar control variables, and the mean value of the control group samples is lower than that of the experimental group by 0.452, which implies that the implementation of the housing market regulation policy that meets the matching conditions can effectively improve the housing choice behavior of urban residents.

| Variable | Sample | Experimental group | Control group | Difference | Standard error | t value |

| Recent adjacent matching results | ||||||

| HSB | Unmatched | 4.295 | 5.303 | -1.008 | 0.516 | 1.527 |

| ATT | 4.295 | 3.843 | 0.452 | 0.628 | 1.435 | |

| ATU | 5.243 | 5.948 | -0.705 | – | – | |

| ATE | -0.701 | – | – | |||

| Radius matching results | ||||||

| HSB | Unmatched | 4.298 | 4.756 | -0.458 | 0.952 | 1.426 |

| ATT | 4.231 | 4.167 | 0.064 | 0.535 | 1.078 | |

| ATU | 4.779 | 5.062 | -0.283 | – | – | |

| ATE | -0.279 | – | – | |||

| Nuclear matching results | ||||||

| HSB | Unmatched | 4.297 | 4.753 | -0.456 | 0.952 | 1.425 |

| ATT | 4.232 | 4.198 | 0.034 | 0.581 | 1.041 | |

| ATU | 4.757 | 5.106 | -0.349 | – | – | |

| ATE | -0.342 | – | – | |||

After verifying that the two groups of residents’ housing purchase price indexes satisfy the parallel trend test, this paper firstly conducts the basic DID regression for the full-sample data to investigate whether the implementation of the housing market control policy has an impact on the housing choice behavior of urban residents in the true enhancement. Table 3 shows the results of the basic DID regression for the full-sample data, in which the coefficient of the interaction term Time*Treat represents the effect of the implementation of the housing market regulation policy. Model (1) represents the estimation results of the residential housing purchase price chain index (HSB) obtained without adding any control variables, while models (2) to (4) represent the regression results of HSB after adding control variables closely related to housing purchase price. Values in parentheses in the table are t-statistics, *p<0.1, **p<0.05,***p<0.01.

The regression analysis found that the effect of the housing market regulation policy on the residential housing purchase price chain index is 0.428, and passed the 1% significance test. This indicates that the housing market regulation policy can, to a certain extent, play a contributing role in the housing choice behavior of urban residents. After adding the control variables related to house prices such as regional gross domestic product (Ln-GDP), consumer price index (CPI), real lending interest rate (Rate), real estate investment share (Invest), and the number of urban resident population (Ln-PP), the regression coefficient is still significantly positive and reduced from 0.428 to 0.351 at 1% level, indicating that there are some influencing factors on the policy, which can contribute to the behavior of the housing market. This indicates that there are some influencing factors that can weaken the implementation effect of the policy, and if the relevant factors cannot be effectively controlled, the regression results will lead to a certain bias. The above results show that the housing market control policy in general has a significant positive impact on the housing choice behavior of urban residents, but with the increase of control variables, this impact will gradually weaken and reduce. Due to certain differences in the level of economic development between cities, even if cities of different levels have introduced housing market control policies, the policy strength and effect are not the same, and the impact of the purchase restriction policy on different floor areas of commercial housing will also be different. On the whole, the effective implementation of housing market control policies helps urban residents to make housing choices, so as to meet the housing needs of urban residents.

| Variable | Model (1) | Model (2) | Model (3) | Model (4) |

| Time*Treat | 0.428***(4.928) | 0.415***(4.427) | 0.389***(4.176) | 0.351***(4.003) |

| Ln-GDP | – | 0.145**(0.538) | 0.141**(0.515) | 0.139**(0.492) |

| Ln-PCDL | – | 0.038*(1.142) | 0.032*(1.137) | 0.027*(1.101) |

| CPI | – | 0.026*(1.735) | 0.023*(1.709) | 0.019*(1.543) |

| M2 | – | – | 0.085**(2.174) | 0.078**(2.117) |

| Rate | – | – | 0.343***(0.958) | 0.328***(0.931) |

| Ln-SQR | – | – | – | -0.163**(-4.174) |

| INVEST | – | – | – | 0.068(1.263) |

| Ln-Sales-area | – | – | – | -0.202***(-3.289) |

| Ln-Sales | – | – | – | 0.124**(2.435) |

| Ln-PP | – | – | – | 0.078(0.316) |

| Ln-Land | – | – | – | 0.475***(2.817) |

| (Con_) | 1.274***(5.415) | 1.842**(2.816) | 2.493**(1.942) | 3.006*(1.308) |

| Adj.R2 | 0.001 | 0.005 | 0.008 | 0.014 |

| F statistic | 23.514 | 15.463 | 10.279 | 7.528 |

Usual experiments are followed by robustness tests after the empirical analysis to confirm the accuracy of the conclusions obtained from the empirical analysis. Therefore, this paper adopts the placebo test for additional empirical evidence. The placebo test is to test whether the statistics are still significant after regressing the original model by constructing a fictitious policy implementation time. If the coefficient remains significant, it indicates that the conclusions obtained under the fictitious policy implementation time are consistent with those obtained under the real implementation time, and that the conclusions previously obtained are likely to be in error. If the coefficient is not significant, it means that the previous results are correct and the fictitious policy implementation time cannot get the above conclusion.

Based on the above theory, this paper moves the implementation time of the housing market regulation policy one year forward or one year backward, respectively, to see whether the coefficients of the main variable Time*Treat at this time can continue to support the result. If the coefficient of the main variable Time*Treat is still significant, it means that the changes in the housing choice behavior of urban residents are not brought about by the implementation of the housing market regulation policy. If it is not significant, it means that the fictitious time of policy implementation cannot get that conclusion and the conclusion of the previous empirical analysis is robust. Table 4 presents the results of the placebo test, where models (1) and (2) represent the results of the test shifted one year forward and one year backward, respectively.

The results of the placebo test show that the coefficients of the main variables of the model, Time*Treat, are 0.095 and -0.021, respectively, but this coefficient is not significant regardless of whether it is positive or negative. Therefore, whether the housing market control policy implementation time is shifted forward one year or backward one year, the conclusion obtained is not significant. This proves that the conclusion of the previous empirical analysis is correct, that is, the effective implementation of housing market regulation policy can significantly affect the housing choice behavior of urban residents.

| Variable | Model (1) | Model (2) | ||

| Coefficient | P value | Coefficient | p value | |

| Time | 0.027 | 0.212 | 0.235 | 0.237 |

| Treat | 0.003 | 0.465 | -0.082 | 0.534 |

| Time*Treat | 0.095 | 0.673 | -0.021 | 0.131 |

| Ln-GDP | -0.331 | 0.736 | -0.067* | 0.095 |

| Ln-PCDL | -0.312 | 0.508 | -0.135*** | 0.008 |

| CPI | -0.274 | 0.391 | -0.113 | 0.631 |

| M2 | 0.172*** | 0.005 | 0.291 | 0.243 |

| Rate | -0.309*** | 0.003 | 0.114 | 0.546 |

| Ln-SQR | 0.085 | 0.621 | 0.002* | 0.072 |

| INVEST | -0.003** | 0.034 | 0.187 | 0.263 |

| Ln-Sales-area | -0.127 | 0.713 | -0.129*** | 0.008 |

| Ln-Sales | 0.289 | 0.212 | 0.235 | 0.237 |

| Ln-PP | 0.206* | 0.065 | -0.082 | 0.534 |

| Ln-Land | 0.317 | 0.673 | -0.021** | 0.031 |

The article carries out quantitative data analysis around the housing choice behavior of urban residents, aiming to explore the specific impact of the implementation of housing market regulation policies on the housing choice behavior of urban residents. Without other variables, the coefficient of the impact of the housing market regulation policy on the housing choice behavior of urban residents is 0.428, which is significant at the 1% level. Whenever the implementation effect of the housing market regulation policy is increased by 1 percentage point, the housing choice behavior of urban residents will be enhanced by 0.428 percentage points, which means that the housing market regulation policy will significantly affect the housing choice behavior of urban residents. Even after the gradual addition of control variables in the model, the housing market control policy still has a significant impact on the housing choice behavior of urban residents at the 1% level. Combined with the results of the placebo test, it can be seen that the regression results of the PSM-DID model are robust. Therefore, actively optimizing the housing market control policy can help to better enhance the willingness of urban residents to buy housing, and to a certain extent, help the concept of “a place to live” come into effect.